2024 was a complex and dynamic year for Türkiye’s particleboard industry. Despite swings in the global economy, shifts in raw-material prices and challenges in the domestic market, the sector sought to preserve production capacity while staying active in export markets.

Production Capacity and Market Position

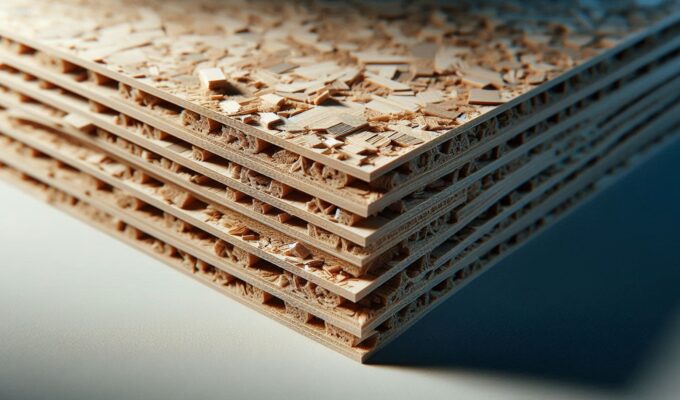

Türkiye’s particleboard industry is a core raw-material supplier to furniture and construction.

- Scale and capacity: Türkiye ranks among Europe’s leading particleboard producers, with substantial installed capacity using modern manufacturing technologies.

- Domestic focus: Output is largely geared to domestic demand. Furniture, interior fit-out, construction—especially interior applications—and packaging are the main end uses. In 2024 higher home sales combined with momentum in furniture supported demand to a degree.

- Capacity utilization: CU fluctuated through the year. While global uncertainty with domestic conditions occasionally drove dips, the sector remained broadly active.

Raw-Material Dynamics

Feedstock—particularly wood and wood residues—is critical.

- Input prices: Prices for wood and wood chips fluctuated in 2024. Rising energy costs with global supply-demand imbalances pushed input costs higher.

- Supply chain: The industry relies largely on domestic wood supply. Forest management, sustainability principles and waste management remained vital for stable feedstock availability.

Exports and Competition

Although domestically oriented, the industry continued to leverage export potential.

- Export volume: Shipments of particleboard and related wood-panel products maintained activity in selected markets. Neighboring countries and the Middle East remained key destinations.

- Global competition: Competition with major European and Asian producers stayed intense, with price, quality and logistics as key differentiators.

Trends and Technology

The industry kept aligning with global trends in 2024.

- Sustainability and environmental focus: Sustainable forest management, eco-friendly processes with low-formaldehyde-emission products came to the fore, alongside greater use of recycled wood waste.

- Higher value-added products: Beyond standard particleboard, producers sought to expand output and exports of melamine-faced particleboard, MDF with other processed panels to lift profitability and competitiveness.

- Technology investment: Automation with modern lines continued to raise efficiency, lower costs and improve quality.

Challenges

- Input costs: Rising wood with energy costs squeezed margins.

- FX volatility: Currency swings affected cost planning and competitiveness for firms using imported inputs or exporting.

- Domestic-demand swings: Housing with furniture demand moved with macro conditions and interest rates, adding uncertainty.

- Logistics costs: Higher transport with logistics expenses lifted final prices at home and abroad.

2024 was demanding yet strategic for Türkiye’s particleboard industry. Despite global and local pressures, the sector focused on preserving capacity and strengthening its market position with higher value-added products. Feedstock management, sustainability with technological adaptation will remain key to future success.