Luxera GYO Chairman Ramazan Taş noted that home sales hit record levels in September, adding that declining interest rates are both boosting mortgage use and restoring housing as an investment vehicle.

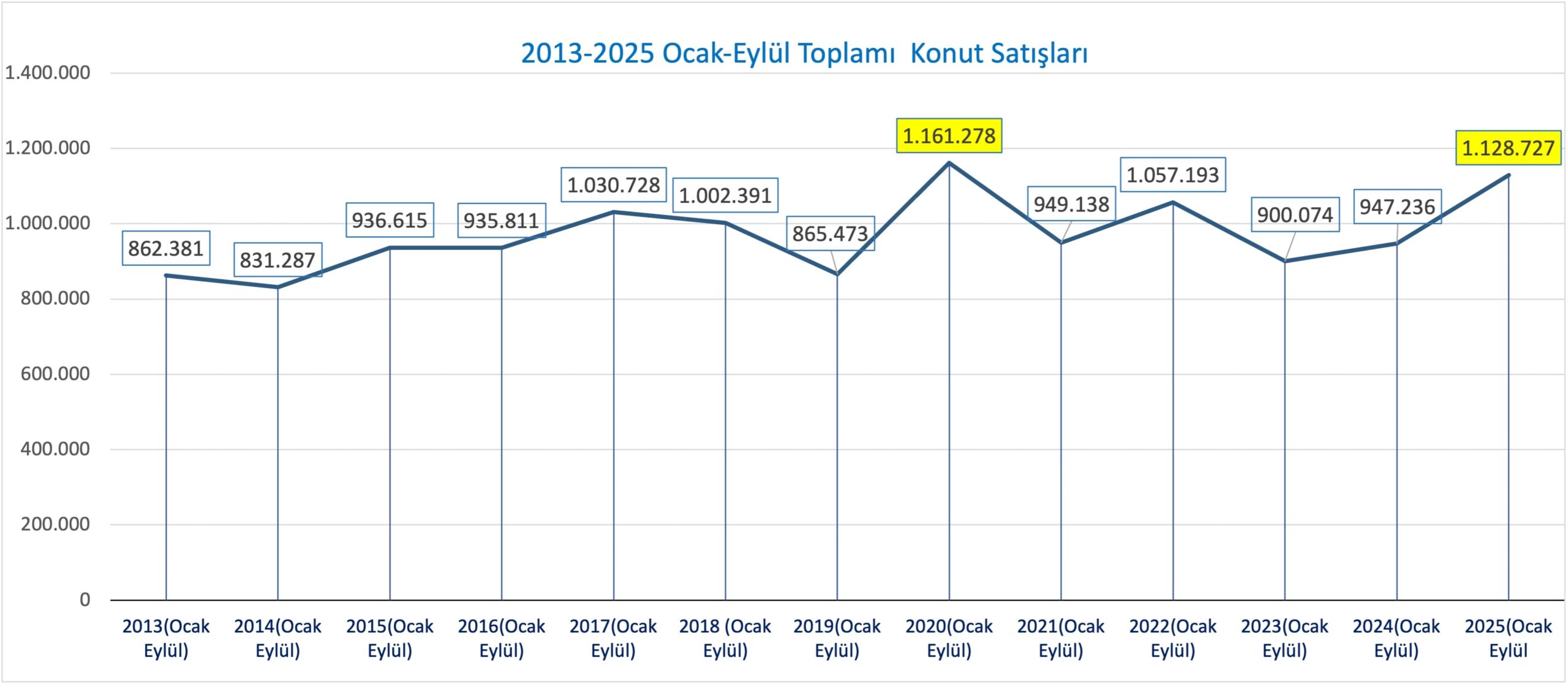

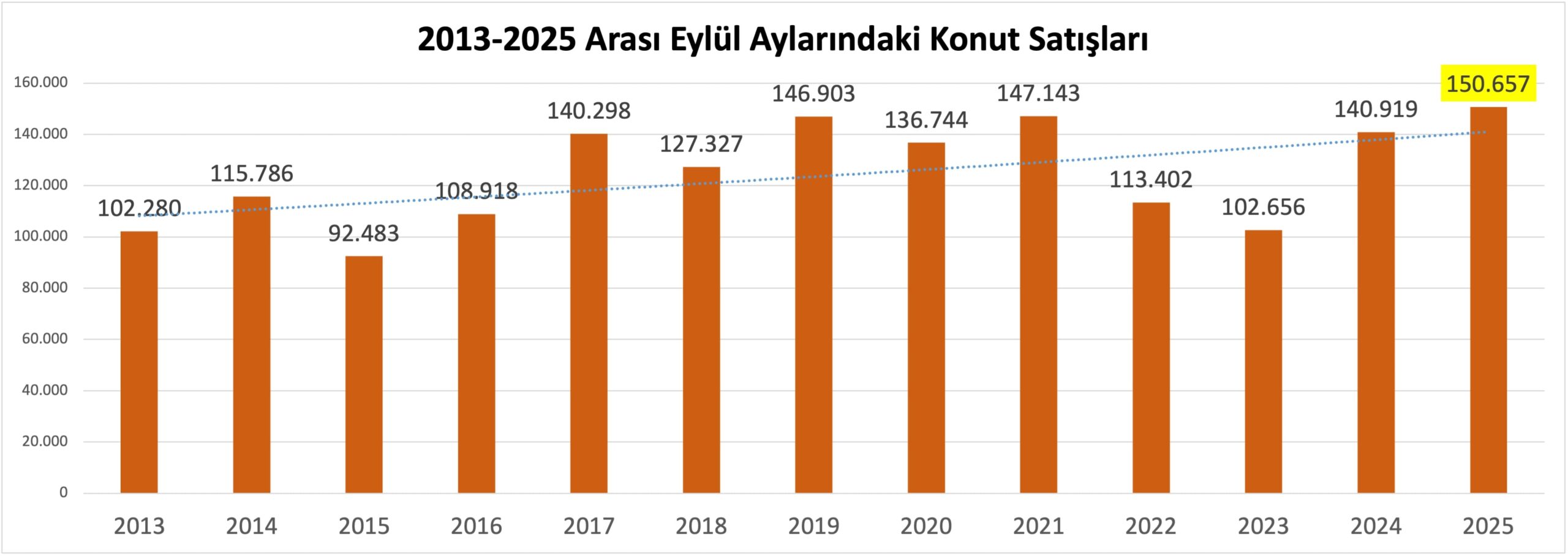

According to TurkStat, housing sales across Türkiye rose 6.9% year-on-year in September to 150,657. In January–September, sales increased 19.2% to 1,128,727. Mortgaged transactions also climbed: up 34.4% year-on-year in September to 21,266, lifting their share of total sales to 14.1% (vs. 13.8% in August, 12.9% in July, 13.4% in June). In the first nine months, mortgaged sales jumped 76% to 162,493.

Highlighting the continued momentum, Taş said: “Although the pace is lower than the sharp gains seen in April–July, housing sales rose 6.8% in August and 6.9% in September on an annual basis. The 150,657 units sold last month mark the highest September on record. This gives the first signals that 2026 will be a better year for the housing market.”

Taş added that the 19.2% increase in total sales over the first nine months shows demand is rising throughout the year: “Sales were 947,000 in 2024; in 2025 they rebounded to 1,128,000, approaching the 2020 record.”

Falling rates, rising mortgaged sales

Sharing his outlook for steady, moderate growth, Taş said: “With the ongoing disinflation process in the Turkish economy, further rate cuts and new project launches, we expect a stronger performance in 2026. In September, the Central Bank cut the policy rate by 250 bps to 40.5%. Another cut at the 23 October MPC meeting would further stimulate housing loans. Still, because September inflation surprised to the upside, the CBRT may deliver a smaller cut or stay on hold. Barring unexpected developments, the consensus is for further easing in the coming months, which will make mortgaged purchases more attractive through the rest of the year and into 2026.”

Housing Price Index up 32.2% year-on-year in September

Referring to today’s CBRT release, Taş noted: “The Housing Price Index (HPI) rose 1.7% month-on-month in September to 195.7. Year-on-year, the HPI increased 32.2%, implying a 0.8% real decline. Read together with September sales, this suggests consumers have started buying in anticipation of future price increases. That trend should continue as rate cuts progress.”

Demand rising, prices set to increase

Taş underlined that Türkiye’s housing need remains strong: “Meanwhile, falling deposit rates are making housing an investment again, pushing demand higher. However, rising construction costs and still-limited supply point to further price increases ahead. Therefore, anyone with savings, financial capacity and a genuine need should act without delay and purchase a suitable home under current conditions.”